The Deloitte Société d'Avocats Global Investment and Innovation Incentives department was created in 2004.

It includes 50 industry specialists and 5 partners dedicated to research and development taxation and financing, based in Paris, Lyon and Marseille.

The team's expertise and original structure make it one of the most renowned practices in the market.

A Comprehensive and Multidisciplinary Team

Our staff includes tax lawyers, engineers and scientists, who work together daily on briefs.

Our engineers have a wealth of experience in industry and/or public research. They routinely work together with our tax experts on EIF projects.

These professionals are all fully employed by the firm in order to ensure the very best levels of reactivity, quality and confidentiality in all cases.

The team is structured into 5 technical divisions:

- Chemistry and life sciences

- Agri-business and food

- IT and communications

- Electronics, energy and physics

- Mechanics and mechatronics

It also includes two cross-division departments:

- Tax Structuring

- Public financing

A Strategic Advantage: The Deloitte International Network

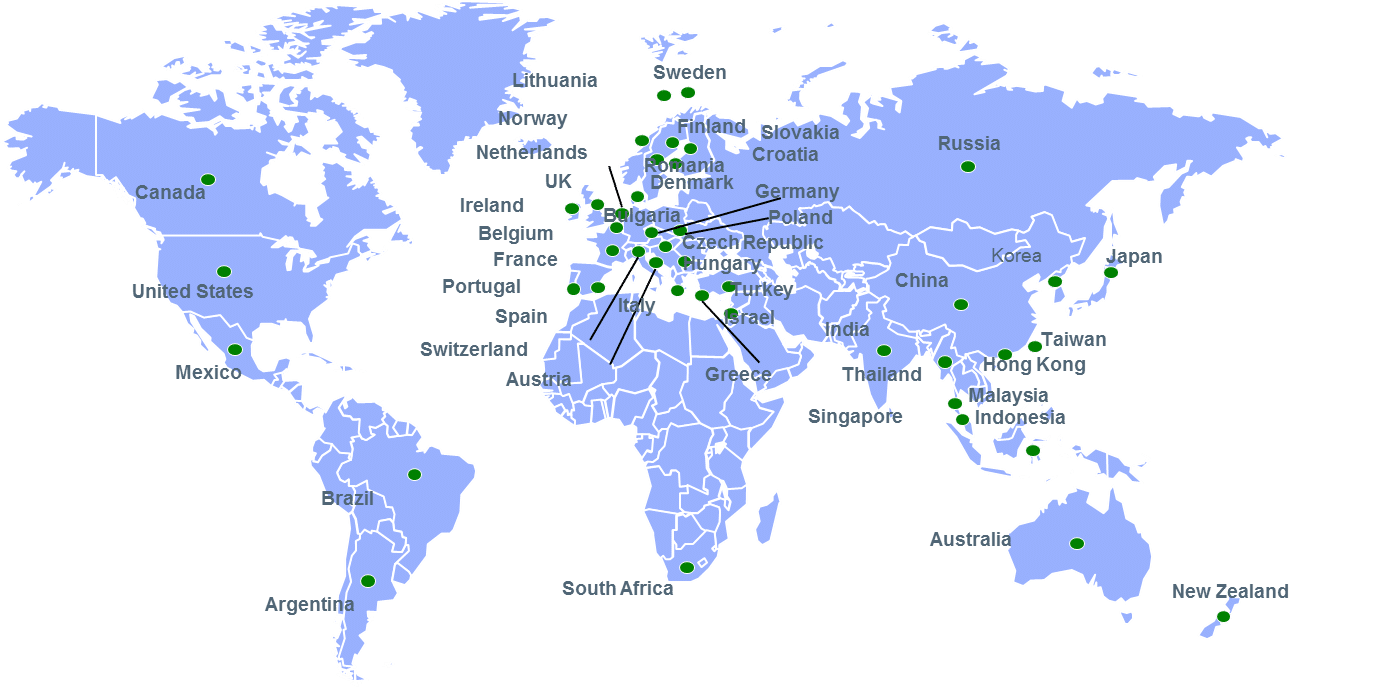

Our team is partnered with the “Deloitte Global R&D” line of services, which includes more than 900 people around the world, distributed across more than 40 countries.

This structure allows us to provide a coordinated response to all challenges related to taxation and global financing in innovation and research.

Recognised Expertise

The team has a recognised presence and experience in EIF proceedings (LEEM, AFEP, MEDEF, etc.) and is a market player recognised by public authorities (Audit Court, tax authorities, French Ministry for Education, Higher Education and Research, Business Mediation).

It also enjoys a strong reputation through its various publications, conferences and industry events.

Deloitte Société d'Avocats listed as a key player in R&D Tax Relief and Credits

As part of a new mechanism seeking to encourage innovation and research, the innovation initiative of the business mediation department of the French Ministry for the Economy, Industry and Digital Economy, listed Deloitte Société d'Avocats as a major player in research and innovation tax credit advice.

As part of a new mechanism seeking to encourage innovation and research, the innovation initiative of the business mediation department of the French Ministry for the Economy, Industry and Digital Economy, listed Deloitte Société d'Avocats as a major player in research and innovation tax credit advice.

This recommendation is an indicator of confidence for companies advised by Deloitte Société d'Avocats in setting up their innovation chain, and new recognition of the firm's expertise in the field of innovation financing.

To find out more about the innovation initiative of the Business Mediation department…

A Management Approach That Values Your Intellectual Property

EIF submissions create special risks in terms of economic intelligence and security because they unite and present specific elements of your company's scientific and technical property.

Deloitte Société d'Avocats is primarily a law firm with a particular professional code of ethics (professional confidentiality) that also apply to our engineers and scientists.

We therefore have specialist expertise in both litigation and regulatory contexts.

A Structured Offer

Research and Development Tax Credits

Our range of Research and Development Credit services can be broken down into three types of project, depending on the level of process maturity implemented by you as the client and, in particular, depending on how far you are willing to internalise all or part of this process:

- “Standard” R&D project: management of all processes used to determine the level of tax relief by our teams, with a systematic review of all fiscal and technical decisions by the taxation department and handling of all documentation up to, if necessary, the drawing up of technical files (and not simply co-authoring)

- “Process” project: tailored support with the general methodology for determining R&D relief or specific themes, i.e. training in auditing, eligibility and/or drafting, diagnostics, implementation of KPIs, etc.

- International Strategic Review: application of the two previous approaches to an international context

- Litigation, auditing and appeals: auditing R&D Tax Relief and Credits is often a complex exercise, in which the expertise of our in-house team of experienced engineers and lawyers comes into its own

Assistance for R&D and innovation

Beyond the R&D Tax Credit, there are a number of other mechanisms that can be used to provide an additional stream of funding for your company's R&D activities (direct state aid), from local resources to those of the European Commission.

We can support you in collaborative projects and their financing, throughout the feasibility, submission and follow-up phases.

More generally, adapting the brief to the specific requirements of our clients is in our DNA: more than half of our briefs are specific, requiring support in tax audits, training, or assistance internalising and optimising the existing R&D Tax Relief process, etc.

Specialist Tools

Where relevant, we offer:

- A secure web platform allowing computer-aided teamwork on all documents exchanged throughout the project

- A dedicated R&D Credit platform, allowing the effective management of the tax relief process, in particular in complex organisations